Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You're not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

The Numbers May Make It Tempting

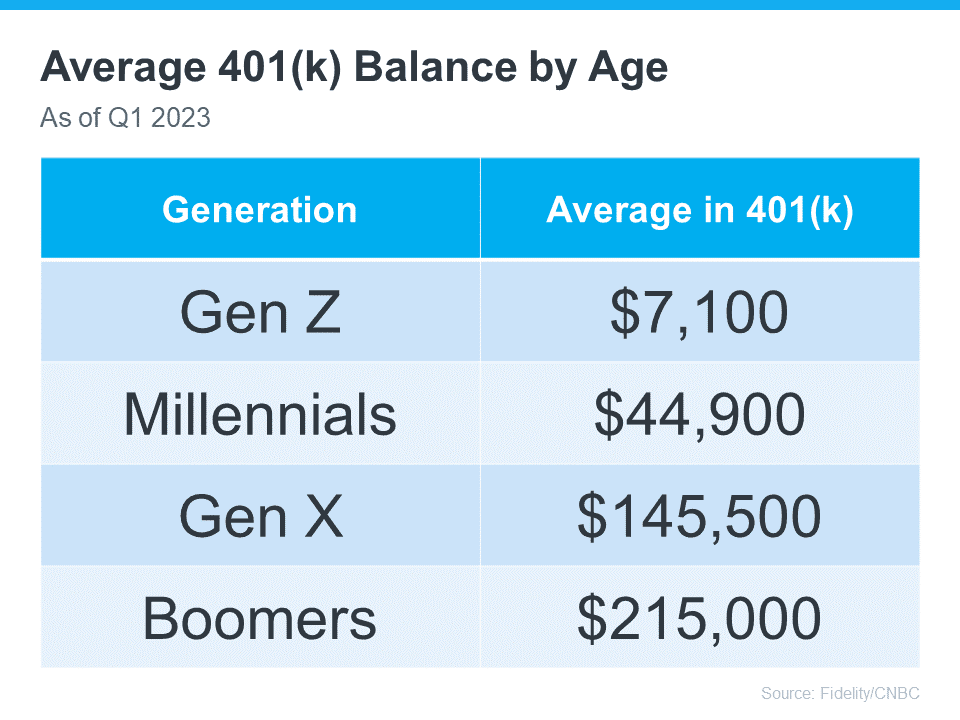

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That's why it's important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it's not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

- FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home's price, depending on their credit scores.

- Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Bottom Line

If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.