Are you on the fence about selling your house? While affordability is improving this year, it’s still tight. And that may be on your mind. But understanding your home equity could be the key to making your decision easier. An article from Bankrate explains:

“Home equity is the difference between your home's value and the amount you still owe on your mortgage. It represents the paid-off portion of your home.

You'll start off with a certain level of equity when you make your down payment to buy the home, then continue to build equity as you pay down your mortgage. You'll also build equity over time as your home's value increases.”

Think of equity as a simple math equation. It's the value of your home now minus what you owe on your mortgage. And guess what? Recently, your equity has probably grown more than you think.

In the past few years, home prices skyrocketed, which means your home's value – and your equity – likely shot up, too. So, you may have more equity than you realize.

How To Make the Most of Your Home Equity Right Now

If you're thinking about moving, the equity you have in your home could be a big help. According to CoreLogic:

“. . . the average U.S. homeowner with a mortgage still has more than $300,000 in equity . . .”

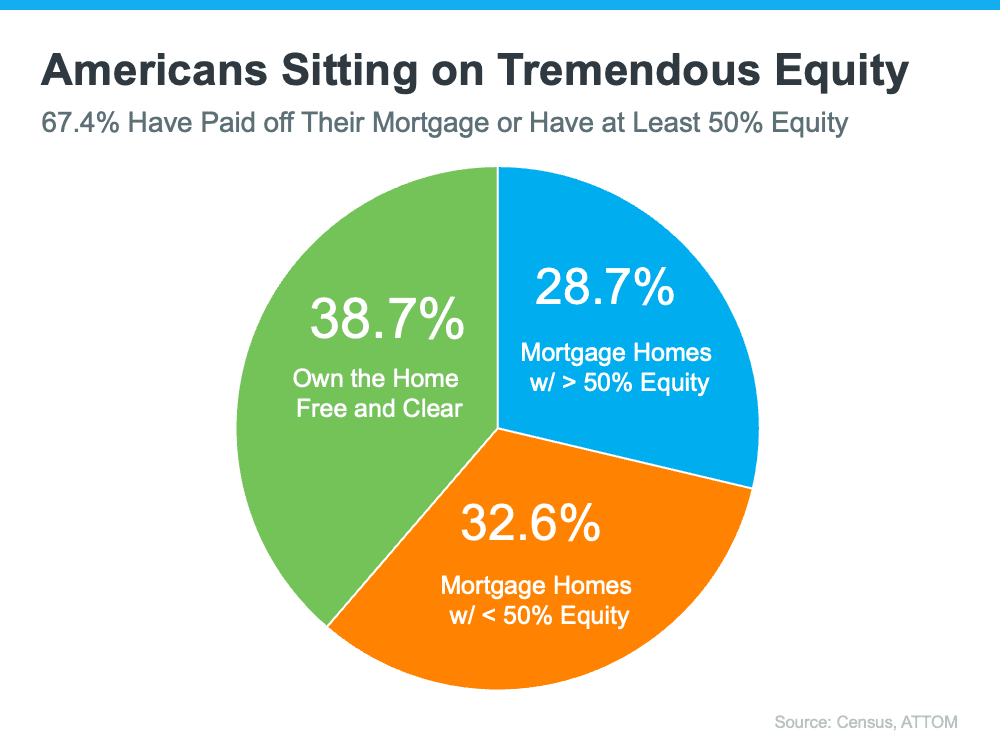

Clearly, homeowners have a lot of equity right now. And the latest data from the Census and ATTOM shows over two-thirds of homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity (shown in blue in the chart below):